Surveys vs. focus groups: choosing the best method for customer insights

Use surveys and focus groups to collect feedback and gather well-rounded insights to drive business success.

Understanding your customers is essential for any successful business. Whether you're developing new products, refining your marketing strategy, or enhancing customer experience, gathering accurate customer feedback enables you to make better decisions.

But how do you choose between running a survey or organizing a focus group? Both methods offer valuable insights, but they serve different research purposes and deliver distinct types of data.

This comprehensive guide will help you decide between surveys and focus groups. It will ensure that you select the methodology that best aligns with your research objectives and provides the most valuable customer feedback. It will also explain when to use a focus group survey approach that combines elements of both methods.

What is a survey?

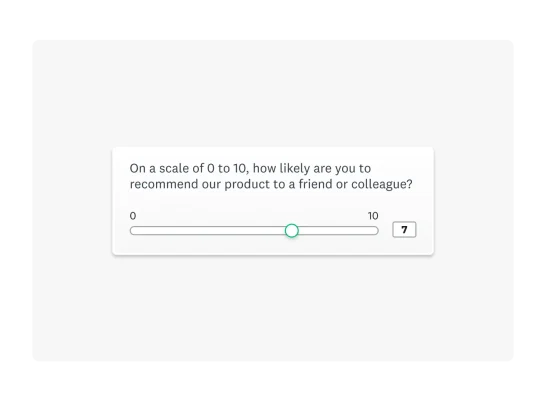

A survey is a research method that collects standardized data from a sample of respondents through a series of questions. Surveys primarily gather quantitative data. Qualitative research allows researchers to gather numerical data that can be analyzed statistically to identify patterns, trends, and correlations.

Surveys are versatile tools that can accommodate various question formats, from multiple-choice and rating scales to open-ended responses. They're particularly effective for collecting customer feedback from large, diverse populations, making them ideal for market research, customer satisfaction measurement, and opinion polling.

Key characteristics of surveys include:

- Scalability: Can collect feedback from hundreds or thousands of respondents

- Standardization: Uses consistent questions for all respondents

- Flexibility: Can be distributed through multiple channels (email, web, mobile, etc.)

- Quantifiability: Produces numerical data that can be statistically analyzed

- Cost-effectiveness: Typically less expensive per respondent than other research methods

- Convenience: Respondents can complete surveys at their own pace and preferred time

- Anonymity: Offers respondents privacy for sharing honest feedback

- Repeatability: Can be easily replicated over time to track changes

What is a focus group?

A focus group is a method of qualitative research that involves a small gathering of participants to engage in a guided discussion about a specific topic. This interactive format is moderated by a trained moderator who guides the conversation while encouraging organic discussion among participants.

Focus groups typically consist of 6-10 participants who share certain characteristics relevant to the research topic. For example, a new target market may be gathered to understand their motivations. The power of focus groups lies in their ability to dive deeper, investigating sentiment through their own words and expressions.

Key characteristics of focus groups include:

- Interactive format: Encourages dialogue between participants

- Small sample size: Typically involves 6-10 carefully selected respondents

- Qualitative data: Generates in-depth insights rather than numerical data

- Moderator-led: Guided by a skilled facilitator who directs the discussion

- Real-time feedback: Allows for immediate follow-up questions and clarification

- Observational opportunities: Enables researchers to note non-verbal cues and reactions

- Group dynamics: Leverages social interaction to stimulate discussion and reveal insights

- Exploratory nature: Ideal for uncovering unexpected findings and generating hypotheses

Surveys vs. focus groups: What are key differences?

While surveys and focus groups gather respondent information, they differ significantly in approach, methodology, and type of data produced. Understanding these differences is crucial for selecting the right research method for your specific objectives.

| Aspect | Surveys | Focus groups |

| Delivery method | Online, paper, or in person | In person or online focus groups |

| Sample size | Large (hundreds to thousands of respondents) | Large (hundreds to thousands of respondents) |

| Data type | Primarily quantitative with some qualitative elements | Primarily qualitative |

| Format | Structured questions with predetermined response options | Semi-structured discussion guided by a moderator |

| Interaction | One-way communication between researcher and respondent | Multi-directional communication among participants and moderator |

| Depth | Broad coverage of topics with limited depth | Deep exploration of fewer topics |

| Time commitment | Brief (typically 5-15 minutes per respondent) | Extended (usually 60-90 minutes per session) |

| Cost | Lower cost per respondent | Higher cost per participant |

| Analysis | Statistical analysis of numerical data | Thematic analysis of transcripts and observations |

| Flexibility | Limited ability to probe or explore unexpected topics | High flexibility to follow interesting tangents |

| Participant anonymity | Can be anonymous | Not anonymous (face-to-face interaction) |

When to use surveys

Surveys are well-suited for market research scenarios that require broad data collection, statistical analysis, and the ability to generalize findings across large populations. They excel in situations where you need to quantify opinions, behaviors, or preferences.

Brand health tracking is one excellent application of online surveys, allowing companies to monitor customer perception over time.

Here are the ideal scenarios for using surveys:

- Tracking metrics and validating hypotheses: When you need to measure KPIs (like NPS®, CSAT, or CES) or test specific assumptions through statistical analysis with large sample sizes.

- Benchmarking and trend analysis: When you want to establish baseline measurements, compare responses across different segments, and track changes consistently over time.

- Reaching diverse or dispersed audiences: When your target market is geographically scattered, or you need representative data from various demographic groups.

- Collecting sensitive or anonymous feedback: When your target market might be more comfortable sharing direct feedback without face-to-face interaction.

- Resource efficiency: When you have budget constraints or tight timelines and need cost-effective data collection that can be implemented and analyzed quickly.

When to use focus groups

Focus groups shine in research study scenarios that demand deep, contextual understanding and the exploration of complex motivations, perceptions, and behaviors. They are particularly valuable when you need to understand the "why" behind consumer decisions or opinions.

Focus groups are ideal in the following situations:

- Early-stage exploration: When you need to identify key issues, develop hypotheses, or generate ideas for further quantitative testing.

- Product and concept testing: When you need detailed reactions to new products, advertisements, or messaging, especially for physical items that people need to interact with or experience.

- Understanding decision processes: When you want to explore how and why consumers make purchasing decisions, including emotional responses and non-verbal cues that surveys might miss.

- Creating rich user profiles: When you want to develop detailed descriptions of your target customers and their opinions, needs, preferences, and behaviors.

- Exploring complex or culturally nuanced topics: When the subject matter requires detailed explanation or when local cultural contexts significantly impact how your product or service is perceived.

Pros and cons of surveys and focus groups

The two methodologies offer distinct advantages and limitations. Understanding these can provide direction based on your specific research needs and constraints.

Surveys

| Pros | Cons |

| Reach large groups quickly and cost-effectively | Limit ability to probe for deeper understanding |

| Produce statistically significant results that can be generalized | Cannot capture non-verbal cues or emotional responses |

| Allow for anonymous responses, potentially increasing honesty | Risk question misinterpretation without clarification opportunities |

| Provide structured data that's easy to analyze quantitatively | Often produce shallow insights on complex topics |

| Enable easy tracking of changes over time with consistent questions | Cannot adapt in real-time based on responses |

Focus Groups

| Pros | Cons |

| Generate rich, detailed qualitative insights | Limited by small sample sizes that may not be representative |

| Allow for immediate follow-up questions and clarification | Can be influenced by dominant personalities in the group |

| Capture non-verbal cues and emotional reactions | Require significant resources (time, venue, moderator, incentives) |

| Leverage group dynamics to stimulate discussion | Present logistical challenges in scheduling and location |

| Provide context for understanding responses | Cannot provide statistical significance or generalizability |

How to choose between surveys and focus groups

Selecting the right research method requires careful consideration of your research objectives, resources, and information needs. Here's a checklist to guide your decision-making process:

- What type of customer feedback do you need?

- Quantitative (numerical, statistical) → Survey

- Qualitative (descriptive, contextual) → Focus group

- Both → Consider using both methods

- What's your primary research objective?

- Measure or quantify something → Survey

- Explore or understand something → Focus group

- Test specific hypotheses → Survey

- Generate hypotheses → Focus group

- What's your budget?

- Limited → Survey (especially online surveys)

- More flexible → Either method or combination

- Substantial → Combination of methods

- What's your timeline?

- Need results quickly → Survey

- Can afford more time → Focus group or combination

- How large a sample do you need?

- Large, representative sample → Survey

- Small, targeted sample → Focus group

- How complex is your topic?

- Simple, straightforward questions → Survey

- Complex, nuanced topics → Focus group

- Do you need to probe for deeper insights?

- Yes → Focus group

- No → Survey

- Is anonymity important for honest responses?

- Yes → Survey

- No → Either method

Remember that surveys and focus groups aren't mutually exclusive. Many successful research projects combine both approaches. For example, group discussions can be used to explore topics and generate hypotheses, and findings can be validated with online surveys. This mixed-methods approach leverages the strengths of both methodologies.

How to run a successful survey

Running an effective survey requires careful planning, thoughtful design, and systematic implementation. Follow these steps to ensure your survey delivers reliable, actionable insights:

Define your objectives

Start by clearly articulating what you want to learn and how you'll use the results. Specific, measurable objectives will guide your entire survey process and ensure you collect relevant data. Ask yourself: What decisions will this survey inform? What specific questions need answers?

Identify your target audience

Determine whose opinions matter for your research questions. Define demographic, behavioral, or other characteristics that qualify respondents. Consider whether you need a random sample or specific segments of your target market, and decide how many respondents you need for statistical significance.

Design the survey

Create questions that directly address your research objectives. Use clear, unbiased language and appropriate question types (multiple choice, rating scales, open-ended questions). Keep your survey concise to prevent respondent fatigue—most respondents prefer surveys under 10 minutes. Organize questions logically, moving from general to specific topics.

Choose the right survey tool

Select a survey platform that meets your needs for question types, branching logic, mobile compatibility, and data analysis capabilities. SurveyMonkey offers robust features for creating professional surveys, along with templates and design tools to streamline the process.

Test the survey

Before the full launch, conduct a test with a small group to identify confusing questions, technical issues, or design problems. Time how long it takes to complete and gather feedback on the survey experience. Make necessary adjustments before distributing widely.

Distribute the survey

Choose appropriate distribution channels based on your target audience—email, website embedding, social media, SMS, or in-person. Consider timing carefully—avoid holidays or busy periods when respondents might be less available. Send reminders to boost response rates without being intrusive.

Analyze the results

Once responses start coming in, begin analyzing the data according to your research objectives. Look for patterns, correlations, and significant differences between segments. Consider both aggregate results and how different respondent groups answered specific questions. Use visualization tools to make insights more accessible.

Take action based on insights

Transform your findings into actionable steps. Share relevant insights with key stakeholders who can implement changes and develop a concrete plan for addressing issues identified in the survey. Close the feedback loop by communicating to respondents how their input is being used.

How to run a successful focus group

Focus groups require careful planning and skilled facilitation to yield valuable insights. Follow these best practices to ensure your focus group delivers meaningful results:

Define your objectives

Establish clear, specific goals for what you want to learn from the focus group. These objectives will guide your discussion topics, participant selection, and analysis approach. Limit yourself to 3-5 key questions to allow for sufficient depth in the discussion.

Identify your target participants

Determine the characteristics of ideal participants based on your research objectives. Consider demographics, experience with your product/service, or other relevant factors. For most focus groups, aim for homogeneity within groups to encourage open discussion, but consider hosting multiple groups with different segments.

Choose a skilled moderator

Select a trained moderator with strong interpersonal skills, topic knowledge, and the ability to manage group dynamics. The moderator should be able to build rapport quickly, remain neutral, draw out quieter participants, and prevent dominant personalities from controlling the discussion.

Develop a discussion guide

Create a semi-structured outline of topics and questions to guide the conversation. Your focus group questions should be non-threatening to build comfort, then progress to more complex topics. Include time estimates for each section and note potential probing questions for deeper exploration.

Select a convenient time and location

Choose a neutral, comfortable setting that's easily accessible for participants. Consider a professional focus group facility with recording capabilities and an observation room. Schedule sessions at times convenient for your target participants, typically lasting 60-90 minutes.

Recruit participants

Develop a screening questionnaire to identify qualified participants. Recruit 20-30% more people than needed to account for no-shows. Clearly communicate the purpose, time commitment, and compensation. Send reminders as the session approaches.

Prepare the logistics

Arrange for refreshments, recording equipment, name tags, and any materials participants need to review. Set up the room with a circular or U-shaped seating arrangement to encourage interaction. Test all technology before participants arrive.

For online focus groups, select a reliable video conferencing platform that allows recording and screen sharing, and consider sending participants technical setup instructions in advance.

Facilitate the focus group

Begin with introductions and ground rules. Create a safe, non-judgmental atmosphere where participants feel comfortable sharing honest opinions. Encourage all participants to answer questions and share opinions in the interactive session. Follow the discussion guide while remaining flexible to explore unexpected but relevant topics. Use probing techniques to dig deeper when needed.

Record and take notes

Capture the session with audio or video recording (with permission - see our consent form templates). Have a note-taker document key points, notable quotes, and non-verbal reactions. Consider using a backroom observer to note important moments and suggest follow-up questions to the moderator.

Analyze the data

Review recordings and notes to identify key themes, patterns, and insights. Look for both consensus views and important outlier perspectives. Consider the context and intensity of comments, not just their content. Use direct quotes to illustrate findings.

Report and share findings

Prepare a clear, concise report that addresses your original objectives for key stakeholders. Include methodology, participant characteristics, key findings, and implications. Use visuals and participant quotes to bring the data to life. Consider creating an executive summary for quick review.

Take action based on insights

Develop specific action items based on the focus group findings. Assign responsibilities for implementation and establish a timeline for follow-up. Consider how these qualitative insights might be validated through quantitative research.

Start your focus group surveys with SurveyMonkey

Rather than viewing surveys and focus groups as competing methodologies, consider how they can work together to deliver comprehensive insights through a mixed-methods approach that leverages the statistical power of surveys alongside the rich, contextual understanding from focus groups.

Ready to elevate your market research? SurveyMonkey offers comprehensive solutions for both survey-based research and focus group recruitment:

- Create professional surveys with SurveyMonkey Market Research Templates and customize them to your specific needs

- Reach your target audience through SurveyMonkey Audience panels for reliable, high-quality responses

- Use Consumer Behavior Templates to understand what drives customer decisions

- Streamline your focus group logistics with registration forms that collect participant information

- Support your demand generation and event marketing efforts with insights from both surveys and focus groups

Whether you're measuring customer satisfaction, testing new concepts, or developing marketing strategies, SurveyMonkey provides the tools you need to gather actionable insights from respondents. Start creating your research plan today and discover the power of informed decision-making.

Net Promoter®, Net Promoter System®, Net Promoter Score® and NPS® are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

Discover more resources

The insights manager's secret to delivering quality research

Insights managers can use this toolkit to help you deliver compelling, actionable insights to support stakeholders and reach the right audiences.

CNBC|SurveyMonkey Small Business Confidence Index Q2 2025

CNBC | SurveyMonkey Your Money April 2025

Half of Americans oppose Donald Trump’s tariffs, citing negative impacts on their finances

Hornblower enhances global customer experiences

Discover how Hornblower uses SurveyMonkey and powerful AI to make the most of NPS data, collect customer insights, and improve customer experiences.